company income tax malaysia

Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less. Paid-up capital up to RM 25 million or less.

How Does The Current System Of International Taxation Work Tax Policy Center

Rate On the first RM600000 chargeable income.

. Last reviewed - 13 June 2022. Prior to December 31 2021 paragraph 28 of Schedule 6 provided that foreign source income received in Malaysia by an individual or company carrying out business other than. The minimum income of RM 50000 is imposed with RM 1800 and excess of up to 70000 has a tax rate of 14.

If the paid-up capital is RM 25 million or less for a resident. For example if you want to reduce. The corporate tax rate for resident and non-resident corporations that include branches of foreign companies stands at.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The standard corporate income tax rate in Malaysia is 24 for both.

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Company with paid up capital more than RM25 million. Following table will give you an idea about company tax computation in Malaysia.

A qualified person defined who is a knowledge worker residing. AF002133 201706002678 A member firm of Malaysian Institute of Accountants MIA Approved Company Auditor Income Tax Agent and GST Agent was. Take advantage of tax incentives for companies in Malaysia.

13 rows 30. The standard corporate income tax rate in Malaysia is 24. On the first RM 600000 chargeable income.

The income of minimum RM 70000 has a flat tax of 4600 and the excess. Following table will give you an idea about corporate tax computation in Malaysia. Income of a resident company from the business of airsea transport banking or insurance is taxed on a worldwide basis.

Other corporate tax rates include the following. Taxation on a worldwide basis does not apply when. Paying income tax due.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million. Company with paid up capital not more than RM25 million. Good article n tax treatment of foreign income received in Malaysia.

Technical Guideline on the Tax Treatment of Foreign Income Received in Malaysia Orbitax Tax News. Corporate - Taxes on corporate income. Resident company with a paid-up capital of RM 25.

The benchmark refers to the highest rate for Corporate Income. On the first RM 600000 chargeable income. Businesses can take advantage of a variety of tax incentives and tax exemption schemes.

Paid-up capital up to RM25 million or less. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24. TANGGUNGJAWAB SYARIKAT Hantar anggaran cukai secara e-Filing e-CP204 atau borang.

Small and medium companies are subject to a 17 tax rate with. Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja. L Co Plt.

The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. For both resident and non-resident companies corporate income tax CIT is imposed on income.

What Is The Difference Between The Statutory And Effective Tax Rate

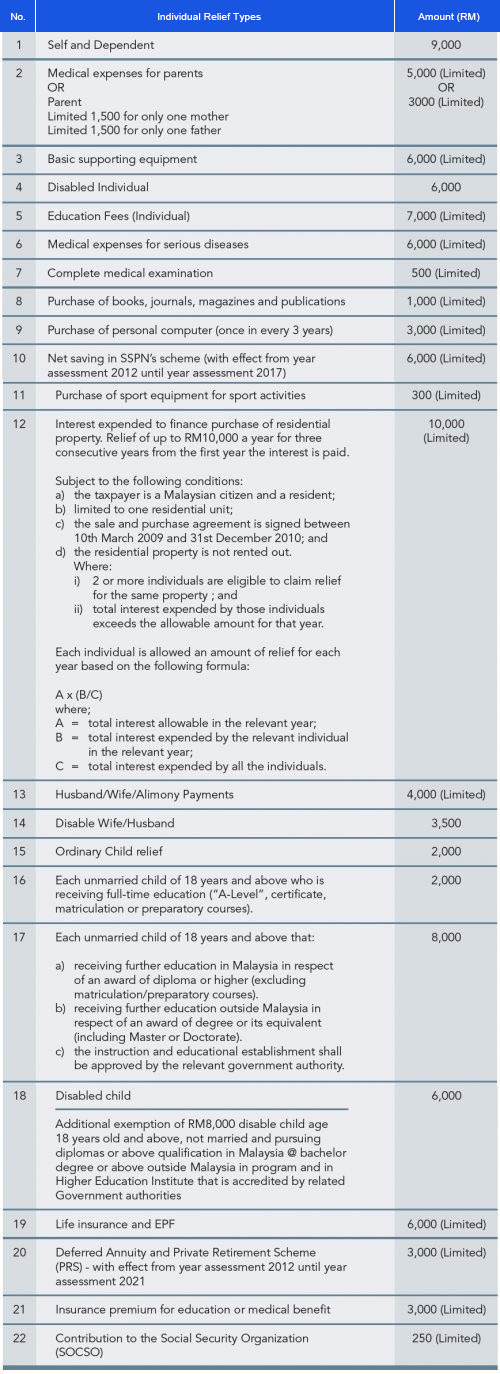

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

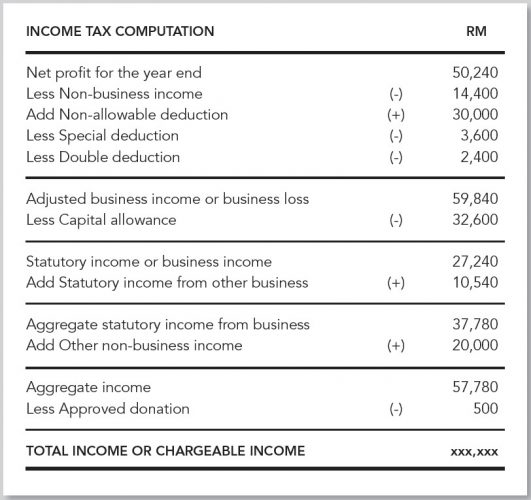

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

What Is The Difference Between The Statutory And Effective Tax Rate

Ktps Consulting Investment Holding Company Ihc With Investment Properties Effective Ya2020 According To The Practice Note No 3 2020 Ihc Not Listed On Bursa Malaysia With Profit From Rent Income Subject To

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Understanding Tax Smeinfo Portal

Understanding Tax Smeinfo Portal

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Small Business Accounting 101 Basics Set Up Software 2022 Shopify Malaysia

Pdf Corporate Tax Avoidance Determinants Of Effective Tax Rate Etr Of Multinational Corporations In Malaysia Semantic Scholar

Latvia Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Malaysia Personal Income Tax Guide 2020 Ya 2019

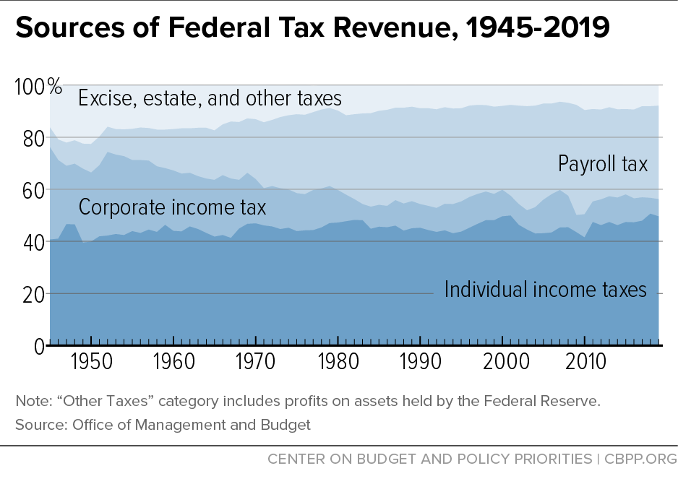

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Tax Season 11 Critical Deductions You Should Know Financetwitter

Value Added Tax And Corporate Income Tax Rate Adjustment In Thailand Download Scientific Diagram

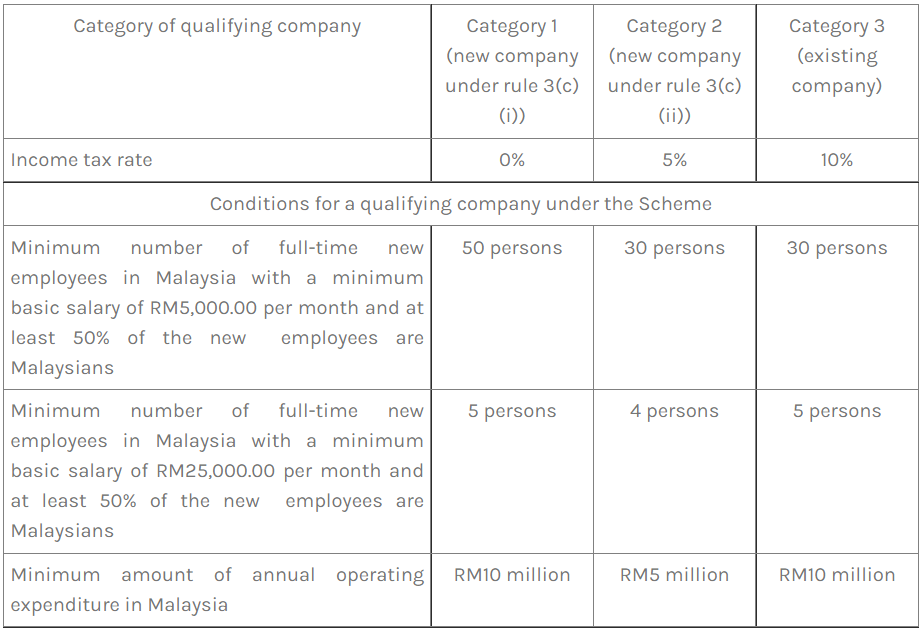

Principal Hub Tax Incentive Rules 2022 Lexology

Liechtenstein Corporate Tax Rate 2022 Data 2023 Forecast 2011 2021 Historical

Comments

Post a Comment